Do you want to be able to use your asset while using it as a collateral on PWN? Do you want to be stated as an asset’s owner in order to be eligible for airdrops or other perks while also using it as collateral on PWN?

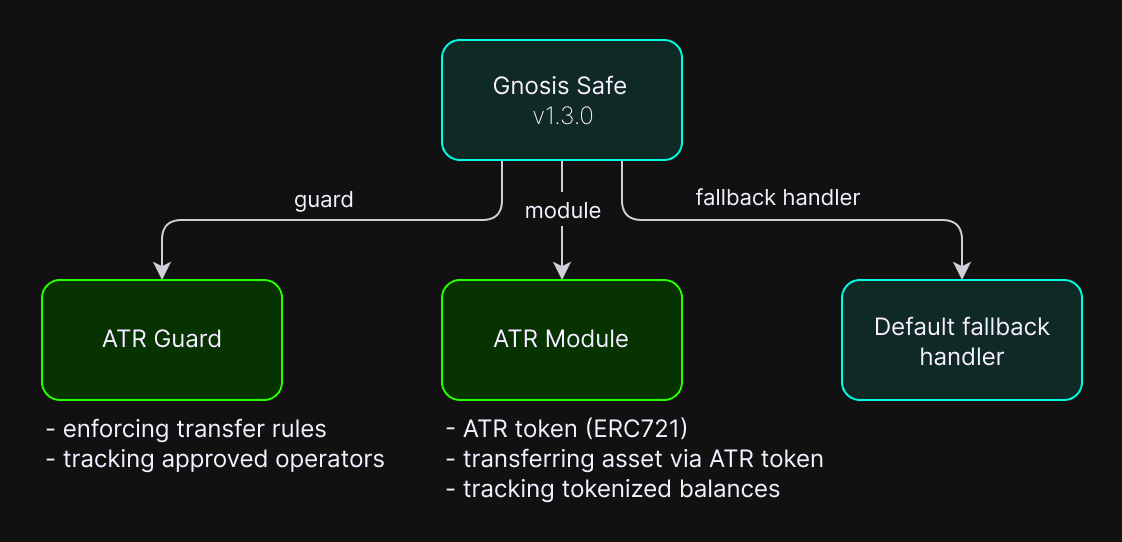

Allow us to introduce PWN’s solution to the above capabilities, PWN Safe. Put simply, a Gnosis Safe guard and module come together to create PWN Safe. This tool enables the safe tokenization of asset transfer rights (ATR) and uses the ATR token instead of the asset itself in the lending protocol as collateral.

In case of default, a lender will be able to claim the ATR token and transfer the underlying asset to its own wallet via ATR token.

The borrower cannot transfer the asset without an ATR token even though they’re the owner of the asset.

Here’s how PWN Safe works

To have a better overview about how PWN Safe works, here’s a step-by-step walkthrough of how users can make use of it.

-

A user deploys a new PWN Safe and transfers assets to it.

-

User 1 tokenizes asset transfer rights and gets an ATR token. From this point, user1 cannot transfer the asset freely and has to use ATR functions instead.

-

User 1 transfers the ATR token to user 2. It could be another PWN Safe, contract wallet, or externally owned account (EOA).

-

Any attempts to transfer the tokenized asset directly will be prevented by ATRGuard and fail.

-

User 2 can now claim the tokenized asset by using its ATR token. ATR token is burned in the same transaction to enable claims to not just PWN Safe, but to all addresses.

What are the benefits of PWN Safe?

When using PWN Safe, a user will remain stated as the asset’s owner across the entire DeFi ecosystem. A user can call any utility function on an asset accessible only to an owner.

Furthermore, PWN Safe unlocks a DeFi mortgage use case, where a buyer is the true owner of an asset, but in case of default, a lender can claim his asset back via ATR token

What’s more, it also unlocks asset renting: The tenant is stated as an owner, but in the case where the tenant stops paying rent, the original owner can claim their asset back via ATR token.

Primary PWN Safe use cases

Keep asset ownership while using transfer rights in DeFi protocols

-

Metaverse land parcel used as a collateral to fund development on that parcel

-

Gaming asset used as a collateral to tap additional liquidity while using the asset in a game and still be able to earn while playing

-

Claiming airdrops while using assets transfer rights as collateral

True rental of asset ownership while keeping transfer rights

This use case is exactly what it sounds like: You get to rent a given asset. In this scenario, the specific renting model depends on the DeFi protocol used to hold the transfer rights.

Here, you can also vest tokens. The tokens are distributed to the owners, but ATR tokens are held in timelock contracts, thus owners cannot sell them.

Taking a look under the technical hood

PWN Safe’s system contains the following components:

1. Gnosis Safe multisig contract wallet

Gnosis Safe is a well-known multisig contract wallet. It defines two very important components (guard and module), both of which are used in PWN Safe to apply constraints on asset transfers and enable the transfer of an asset not owned by a caller from the safe.

2. Asset Transfer Rights (ATR) contract

This contract is used as a Gnosis Safe module. It’s primarily responsible for minting and burning ATR tokens, which are standard ERC-721 tokens. An ATR token can be transferred, used as collateral, approved to transfer, bundled with other tokens, and so on.

An owner of an ATR token is able to transfer a tokenized asset via ATR contract. The caller can decide to burn the ATR token and transfer the asset to any address, or alternatively, keep it and only transfer the asset to another PWN Safe.

3. Asset Transfer Rights Guard

This is used as a Gnosis Safe guard. The guard will assert that any tokenized asset has sufficient tokenized balance after every transaction execution. It also tracks all approved addresses of owned assets to prevent attempts to bypass guards constraints through allowances.

4. PWN Safe Factory

It deploys new instances of PWN Safe. PWN Safe Factory is used to track valid safe addresses which are used by the ATR contract to check that the receiver is indeed PWN Safe while transferring an asset via the ATR token.

ATRGuard and ATR (module) are set on PWN Safe deployment and cannot be changed to prevent a PWN Safe owner from breaking transfer constraints.

Want more? Check out the PWN platform. You can also stay in touch by following PWN on Twitter and joining the PWN Discord community.